In our last blog, we looked at how the Vanderbilts built one of America’s greatest fortunes—and then lost it within a few generations. The Rockefellers, by contrast, built an equally vast empire but took very different steps to ensure their wealth endured. Their success wasn’t just about business—it was about planning ahead, structuring wisely, and preparing future generations.

Acting Early

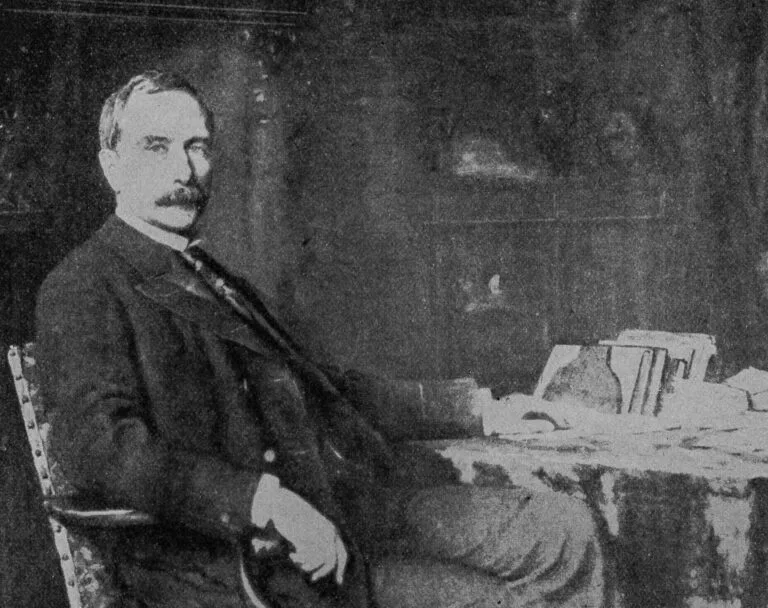

John D. Rockefeller Sr. knew that business success alone doesn’t guarantee a lasting legacy. In 1882, he created the Standard Oil Trust, consolidating his companies under one structure. This move wasn’t just efficient—it provided stability against market volatility and set a precedent for how the family would manage wealth.

From the start, the Rockefellers treated money not as something to be spent freely, but as a responsibility to be managed for the benefit of generations to come.

The Rockefeller Estate Plan

Decades before estate planning became common, the Rockefellers put in place structures that endure even today:

- Dynasty-style irrevocable trusts (1934 and 1952) holding Standard Oil spinoffs and other investments.

- A multigenerational vision, ensuring assets were preserved for grandchildren and beyond.

- Professional management, including the creation of Rockefeller Financial Services, to oversee investments, risk, insurance, venture capital, and philanthropy.

- Family governance, with councils and constitutions that formalized communication and responsibility.

- Life insurance funding to replenish trusts and keep them strong as each generation passed.

Together, these tools created a living system—adaptable, resilient, and designed for the long term.

Did You Know?

The Rockefellers didn’t wait for wealth to erode—they acted early. By 1882, the Standard Oil Trust provided stability and control. By 1934 and 1952, irrevocable dynasty-style trusts were in place, ensuring assets couldn’t be easily spent or dissolved.

Why it mattered:

- Diversification: Their wealth wasn’t tied to a single industry.

- Professional oversight: A family office managed investments and risk.

- Continuity: Life insurance proceeds replenished the trusts over time.

- Governance: Family councils and constitutions formalized communication and accountability.

Today, the Rockefellers still rely on these estate planning structures—proof that foresight and planning can preserve wealth for six generations and counting.

Why It Worked

Unlike other Gilded Age dynasties, the Rockefellers didn’t measure success in palaces or parties. They viewed wealth as stewardship. By combining trusts, diversification, professional oversight, and open communication, they preserved both influence and capital for over six generations.

Their name remains powerful today not only because of wealth, but also because of the foundations, universities, and institutions their planning helped sustain.

Lessons for Modern Families

You don’t need an oil empire to follow the Rockefeller model. The same principles apply to families of all sizes:

- Use trusts to protect assets and guide distribution.

- Diversify investments to withstand economic change.

- Seek professional help to manage and grow wealth responsibly.

- Document governance with clear roles and open communication.

- Plan for continuity, using tools like life insurance to strengthen your estate over time.

Final Thoughts

Where the Vanderbilts left us a warning, the Rockefellers left us a playbook. Their foresight shows that wealth, when paired with structure and communication, can last for generations.

At Staab Law, we help families apply these same principles—using modern estate planning tools to preserve assets, reduce risk, and prepare heirs.

As John D. Rockefeller himself once said:

“I believe that every right implies a responsibility; every opportunity, an obligation; every possession, a duty.”